Credit is at the heart of almost every transaction. Therefore, it is essential that business leaders have as clear a picture as possible of their clients' finances and their ability to pay their debts. Although best known for its services that allow users to check their own credit scores, TransUnion offers a wide range of products geared toward small businesses. Through the company, you can access the data of more than 200 million customers in the United States and check for potentially fraudulent activity, like those described in our best guide to protecting yourself against identity theft. In our review, we take a look at TransUnion's key features, along with its support levels and security precautions. You can then use this information to decide if TransUnion could offer the right credit management solution for your business.

Prices vary based on your specific needs (Image credit: TransUnion)

Plans and prices

Since TransUnion does not publish its prices online, you will need to contact the company directly to receive a personalized quote, and the price you pay will depend on your company's specifications and the services you require. To discuss your needs, you will need to enter details such as your name, company details and the nature of your inquiry into an online form.

The service can alert you to any potentially fraudulent activity (Image credit: TransUnion)

Features

With the company offering so many solutions and features, it wouldn't be possible to list them all here, so we've rounded up their key offerings for small businesses. Through customer credit checks, you can get a broad and detailed view of your customers' credit profiles. TransUnion's database contains data on more than 200 million US consumers. The company's TLOxp omission tracking service helps your company's debt collection function run as smoothly as possible. TransUnion uses trending credit data, which monitors changes in its customers' behavior and accesses alternative data such as social media. This information helps you understand how non-credit behavior influences collections, while TransUnion's scoring and analysis tools can predict potential risk in your portfolio. With the company's TruValidate service, you can develop an accurate overview of your customers through factors such as ownership data, personal data, and online activity. Using this information, TransUnion's global fraud reporting network can notify you of anomalies, assess risk, and help you identify low-risk customers. Designed to protect your company's reputation and restore customer trust, the company's myTrueIdentity service can help you implement a fraud response program. It can, for example, help you notify affected customers if your business is breached.

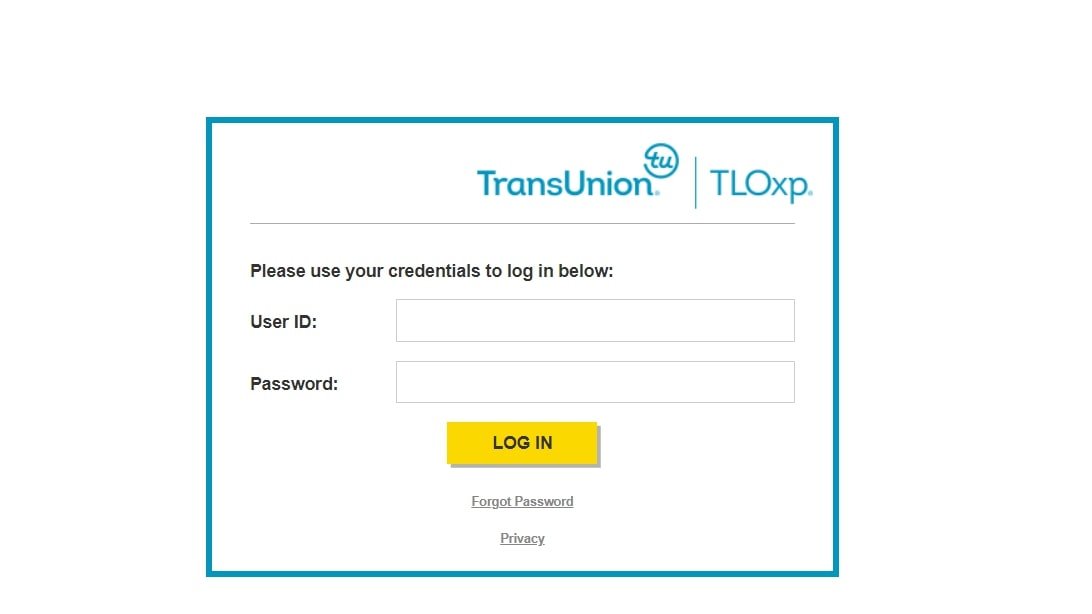

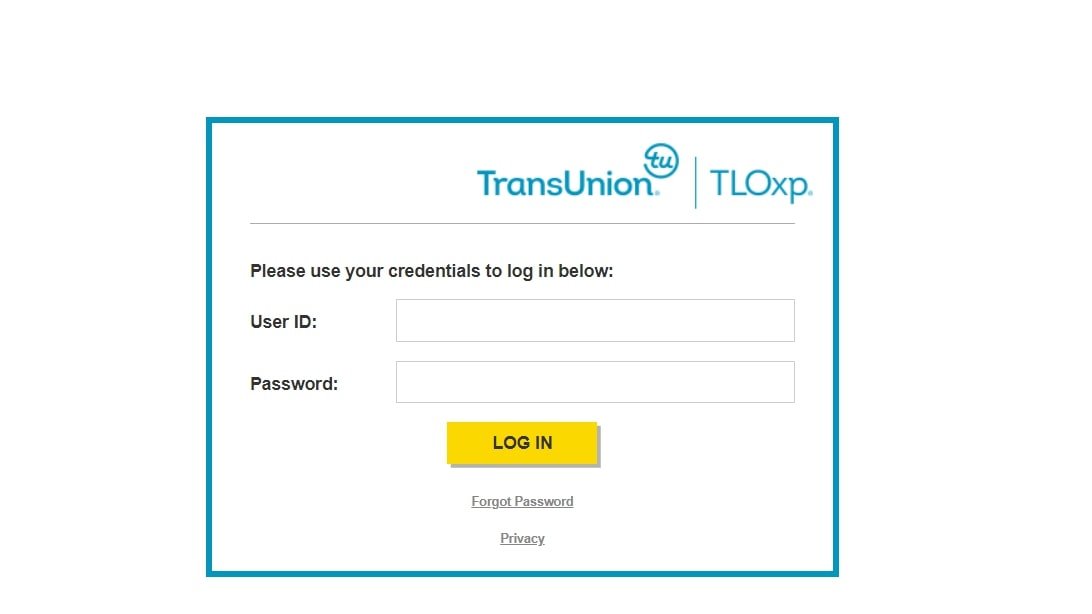

The company operates a self-service tool (Image credit: TransUnion)

Interface and in use

The interface of the software will depend on the product you choose. With the company's TLOxp debt collection software, for example, you'll benefit from a customizable online interface, which can provide a 360-degree profile of any business or consumer. To access this information, all you have to do is enter a name, address, SSN or any other data related to the customer. If you choose TransUnion Express Portfolio Review to view your clients' portfolios, you can upload a Microsoft Excel-compatible file to the company's online self-service tool and choose from a list of more than 30 notes and 200 credit file attributes . You'll typically receive an output file within 48 hours, allowing you to locate and target accounts that meet your desired risk levels.

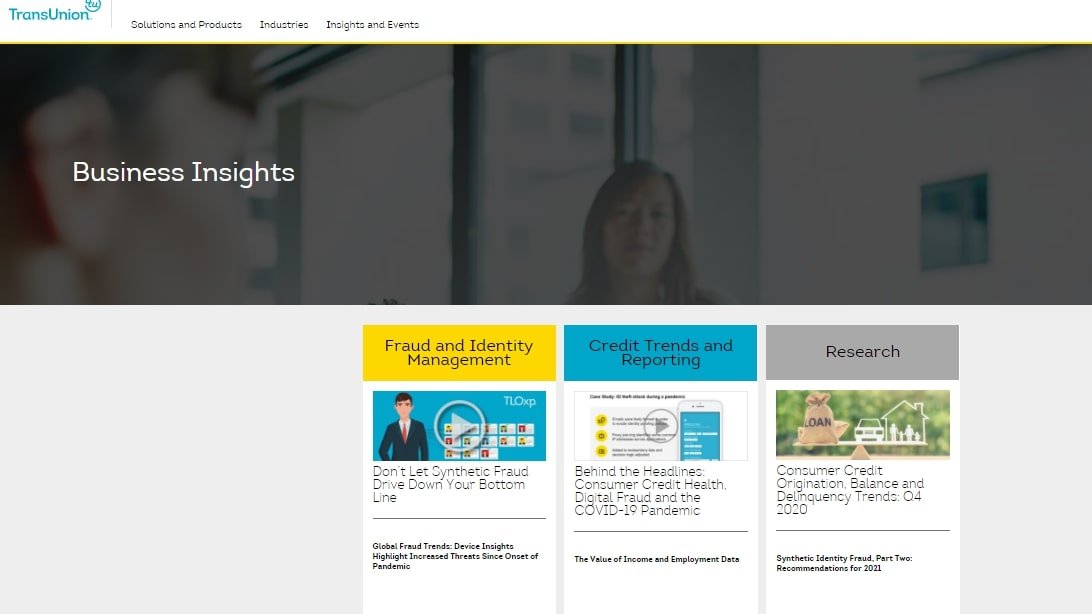

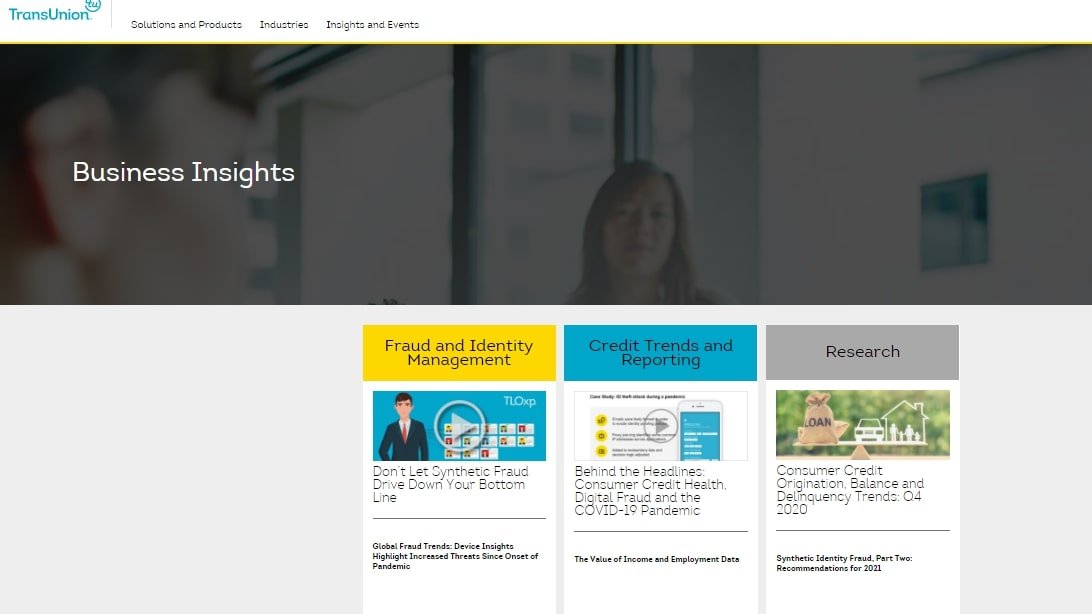

A wide selection of information is available through the company's website (Image credit: TransUnion)

Support

If you have a problem with your TransUnion service, the company's customer service representatives are available by phone Monday through Friday from 7 am to 6 pm, Saturday from 8:30 am to 5 pm and from 9:30 am to 5 p.m. MST on Sundays. You can also contact the company via email, online inquiry form or on social media. The website also has an information section, which is divided into the following categories: fraud and identity management, credit reporting and trends, and research. Even if you're not a TransUnion customer, you can watch webinars on topics like gambling fraud and maintaining revenue integrity.

The company has strong privacy procedures in place (Image credit: TransUnion)

fullfilment of security requirements

When it comes to credit reporting issues, data security is of the utmost importance. To help protect privacy, TransUnion restricts access to its databases to legitimate subscribers and limits account numbers on individual credit reports.

Competition

If you want to track the creditworthiness of your customers, TransUnion isn't the only option for small businesses. Experian is one of the best-known names in the business, and its services include customer credit checks and access to mailing lists of potential customers based on their credit data. Equifax is the other major player in this area and may offer public records or credit alerts if any of the companies or customers you do business with experience financial difficulties.

Insights into future customer behavior are essential (Image credit: TransUnion)

Final verdict

While it's not possible to assess a company's affordability relative to its competitors, the range of features that TransUnion offers businesses is certainly vast, and these features could help you gain insight into your customers' past behavior and, perhaps more important, to provide reliable forecasts about how they are likely to manage their finances in the future. One of TransUnion's most impressive features is undoubtedly its wide selection of online resources, which provide relevant information on topics such as cybersecurity and consumer behavior trends.

Credit is at the heart of almost every transaction. Therefore, it is essential that business leaders have as clear a picture as possible of their clients' finances and their ability to pay their debts. Although best known for its services that allow users to check their own credit scores, TransUnion offers a wide range of products geared toward small businesses. Through the company, you can access the data of more than 200 million customers in the United States and check for potentially fraudulent activity, like those described in our best guide to protecting yourself against identity theft. In our review, we take a look at TransUnion's key features, along with its support levels and security precautions. You can then use this information to decide if TransUnion could offer the right credit management solution for your business.

Credit is at the heart of almost every transaction. Therefore, it is essential that business leaders have as clear a picture as possible of their clients' finances and their ability to pay their debts. Although best known for its services that allow users to check their own credit scores, TransUnion offers a wide range of products geared toward small businesses. Through the company, you can access the data of more than 200 million customers in the United States and check for potentially fraudulent activity, like those described in our best guide to protecting yourself against identity theft. In our review, we take a look at TransUnion's key features, along with its support levels and security precautions. You can then use this information to decide if TransUnion could offer the right credit management solution for your business.