Netflix's rivals have dealt another blow to the world's biggest streamer amid his ongoing subscriber woes.

Yesterday (Tuesday, July 19), Netflix revealed that it lost an additional 970 subscribers between the first and second quarters of 000, a significant loss that is sure to hit it financially at some point, despite a slight increase in its overall revenue.

However, as Netflix tried to put a positive spin on things - namely, talk about the massive success of Stranger Things 4 and a launch window for its ad-supported subscription tier - the streaming giant suffered another blow when it released its report on the results of the second quarter. And, this time, Netflix's main competitors are behind its latest heist.

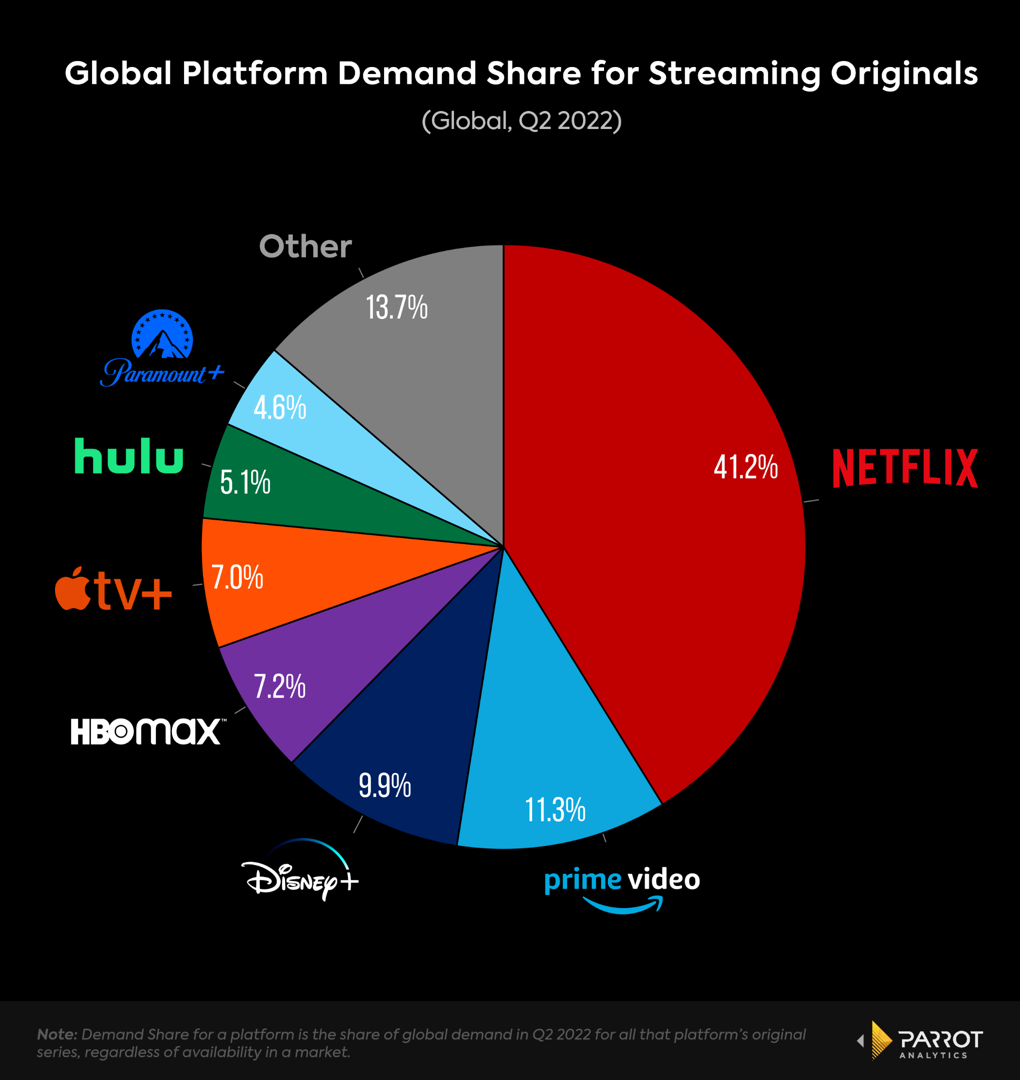

According to leading analytics firm Parrot Analytics, Netflix's six major competitors, including Disney Plus, Prime Video and HBO Max, posted a higher combined global demand share than Netflix for the first time in streaming history.

Along with Hulu, Paramount Plus and Apple TV Plus, Netflix's biggest streaming competitors had 45,1% of the global audience demand for streaming originals. By contrast, Netflix was only able to muster 41,2%, a significant drop of nearly 14% (from 55%) since Q2020 XNUMX.

As the graph above shows, Netflix is still by far the most popular streaming platform. With its 11,3% share of global demand, Prime Video lags far behind in the grand scheme of things, with Disney Plus, HBO Max, and the rest trailing even further behind.

Still, the combined global share of Netflix's competitors is a significant moment in streaming history.

With the exception of Netflix and Prime Video, all other streamers have developed their own share of the global demand for their original content. Share of Disney Plus increased from 8,8% to 9,9%, Paramount Plus from 3,8% to 4,6% (best for newcomer), Apple TV Plus from 6% to 7%, and HBO Max from 6,7% to 7,2%. Netflix was the only one of the Big Six to show a drop in its share of global audience demand for streaming originals.

Clearly, then, Netflix's rivals are making slow progress in their dominance of the streaming landscape, but why?

According to Parrot Analytics, the answer is simple: Netflix's competitors are releasing more original and higher-quality content than ever before.

Again, as the bar chart above shows, Netflix leads its streaming rivals when it comes to audience demand for original programming. That will depend on Stranger Things Season 4, which is the biggest English-language show in the streamer's history: viewers around the world have watched some 1.300 billion hours since Season 4 Part 1 launched in May. . Only Squid Game, which racked up 1560 billion watch hours when it first released in September 2021, has performed better in Netflix's entire history. Well, as far as their original lineup is concerned, anyway.

But Netflix can't afford to pin its hopes on this duo to retain its 220 million subscriber base. Yes, new episodes are on the way in both properties, Stranger Things 5 and Squid Game season 2, which are sure to dominate the TV landscape with each release.

Netflix, however, needs other heavy hitters if it is to keep its competitors at bay. One of his most popular shows on Ozark ended earlier this year, while another on Better Call Saul is currently on its victory lap. Other hits, including The Umbrella Academy, Arcane, and Cobra Kai, have sizable audiences, but none of them can compete with the above quartet.

Meanwhile, Prime Video can boast big hits like The Boys and Invincible. Disney Plus has a slew of Star Wars offerings and Marvel content; the latter will only continue to grow as more Marvel Phase 4 projects hit the platform. Even HBO Max, Hulu, and Paramount Plus have fan-favorite shows right now.

Apple TV Plus, meanwhile, beat out Netflix for one of the latter's most coveted awards, Best Picture at an Oscar ceremony, when CODA received the award at the 2022 Oscars. Apple's streamer on the card and would have It's been hard for Netflix executives to watch.

So Netflix really needs to up its game in the original movies and shows department. There are potential success stories on the way: The Gray Man, a new movie series starring Ryan Gosling and Chris Evans, could give Netflix a very big movie franchise to make for years to come. But, for every movie or TV production Netflix's subscriber base wants to watch, there are a plethora of reality TV deals, engrossing rom-com genre fare, and the cancellation of fan-favorite shows likely to discourage viewers. the spectators.

A change to Netflix's original programming plan, along with other necessary changes, could set back the progress of Disney Plus and the company. However, Tien Zhou, CEO and founder of enterprise software company Zuora, believes that Netflix needs to adapt to do so.

"The death of Netflix has been greatly exaggerated: there are no 'Big Unsubscribes,'" Zhou told TechRadar, lower today than he was before the pandemic.

"What happens is that after being the only player in streaming, Netflix finally has some competition. They're still the king of streaming but, to continue to lead, they can't just focus on acquiring subscribers, they need to focus on bringing back your current subscribers.

"Beyond more shows, Netflix should rethink binge-watching, offer annual packages, and unbundle its content to create smaller, cheaper (and ad-free) offerings. But whatever happens, consumers are the winners."

Of course, streaming fans have never had it better; as Zhou says, we are the winners in all of this. Netflix, however, also wants to keep winning and, based on the ominous warning from its rivals, has a big fight to keep its crown.

For more Netflix-based content, check out our best Netflix shows and highest rated Netflix movie lists.

Today's best Netflix deals