The global value of central bank digital currencies (CBDCs) will rise dramatically, from €100 billion today to €213 billion by 2030, once virtual currency becomes more widely adopted for domestic payments, according to new data from Juniper Research.

By 2030, 92% of the total value of transactions through CBDCs globally will be paid for domestically, as cross-border payment systems face an uphill battle for adoption, Juniper predicted.

Digital currency, which is backed by traditional fiat money such as the US dollar or the British pound, can boost financial inclusion because clients do not need to have a bank account to maintain them; instead, they can use encrypted "digital wallets" that exist in the cloud, on a desktop or laptop computer, or even on a USB storage device.

Vector Images2016/Getty

Vector Images2016/GettyWith a CBDC cross-border payment system, immigrants, for example, could send money back to their home country without having to pay fees that can be exorbitant for electronic money transfers. Businesses could also make cross-border payments for goods and services with much cheaper and faster settlements.

Central bank-backed digital currencies would also reduce the costs of printing and replacing money, help improve fraud detection, and make it easier to trace and recover money paid to fraudsters, according to Lou Steinberg, former chief technology officer at Ameritrade. and Managing Partner of Cyber Security. research firm CTM Insights.

"It would simplify and speed up cross-border payments and reduce the cost and complexity of processing checks, transfers, etc," Steinberg said in an email response to Computerworld. "Unlike cryptocurrencies like bitcoin, a currency backed by the full trust and credit of the United States or another trusted government would provide certainty that the value of the currency is carefully managed. A government can adjust everything from the money supply up to interest while managing and maintaining the value of a fiat currency."

Digital currencies also remove the anonymous nature of consumer cash transactions. In places like China, where spending activities are closely monitored, this would allow the government to know which movies an individual is buying tickets for or spending money in a bar. These are hard to keep up with money.

The United States has been a slow follower compared to other countries, such as China and its digital Yuan, in developing a CBDC. Australia, China, Thailand, Brazil, India, South Korea and Russia already have pilot programs or will start trial programs this year. By 2030, the Bank of England and the UK Treasury plan to launch a CBDC digital pound or “Britcoin”.

According to Steinberg, it matters which digital currency in the country will be widely adopted first, because that government will be able to set the global rules for most others. "Whoever establishes large international payment systems first will have a de facto standard, which the laggards will have to adopt," she said. "The United States continues to explore a digital dollar while others move forward. We must prioritize a system of international payments and settlements based on digital dollars, almost the equivalent of a new generation of SWIFT networks."

The characteristics and standards can be used to design in confidentiality or state supervision and traceability. They can include limited-use currency, such as a dollar type that can only be used for recovery but cannot be saved, or a digital grocery coupon dollar.

“On the other hand, countries like Cuba have two types of currency and limit the use of one type to foreigners only (so they know which of their citizens collect money from foreigners),” Steinberg said. "If we want Western standards for privacy, we have to set the standards. If we want the dollar to retain its role as 'reserve currency,' we have to set the standards for cross-border networks. Being late to the game means you're gambling with the someone else's rules."

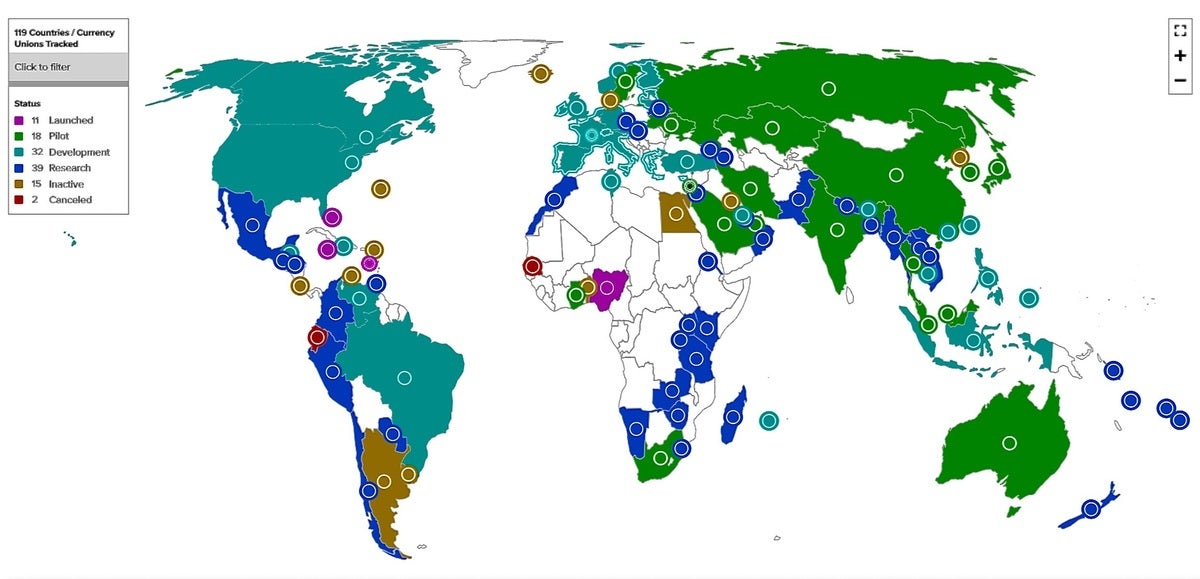

A total of 114 countries representing 95% of global GDP are investigating the creation of CBDCs, according to the Atlantic Council, a Washington-based think tank. Only 10% have launched general CBDC networks. Sixteen percent of the projects are in the pilot stage, 30% in development and 27% still in the research stage, according to the Atlantic Council.

"We arrived late. The good news is that we are starting to realize that,” Steinberg said of the United States.

The Atlantic Council

The Atlantic Council

This map from the Atlantic Council shows the maturity of CBDC projects around the world.

In March 2022, for example, US President Joe Biden issued an executive order calling for more research into the development of a national digital currency through the Federal Reserve Bank, or "The Reserve Federal". The order highlighted the need for increased regulatory oversight of cryptocurrencies, which have been used for nefarious activities such as money laundering. The Fed has been investigating the creation of a CBDC for years.

US lawmakers have also introduced bills that would allow the US Treasury to create a digital dollar. The electronic dollar would allow people to make payments using mobile phone tokens or cards instead of cash.

In November, the Federal Reserve Bank of New York began developing a prototype wholesale CDBC. Dubbed Project Cedar, the CBDC program has developed a blockchain-based framework that is expected to become a pilot in a multinational payment or settlement system. The project, currently in phase 2, is a joint experiment with the Monetary Authority of Singapore to explore issues related to distributed ledger interoperability.

Since CBDCs are issued by central banks, they will initially be primarily for domestic payments, with cross-border payments to take place as systems are established and links are established between CBDCs used by different countries. However, buy-in from cross-border and retail merchants will be crucial to the success of CBDCs.

CBDCs will also need a complex regulatory framework including privacy, consumer protection and anti-money laundering standards, which need to be strengthened before adopting the technology, according to the Atlantic Council. Any new payment system could also compromise the national security objectives of the country that uses it.

“They can, for example, limit the ability of the United States to track cross-border flows and apply sanctions,” the group said. "In the long term, a lack of US leadership and standard setting may have geopolitical consequences, particularly if China and other countries maintain their first-mover advantage in CBDC development."

Steinberg agreed, saying that a fully distributed system carries risks, "both that wallets will be electronically stolen and that the validity of transactions (consensus) can be fooled. A well-designed system could be quite secure today and "ready for the future." future." A poorly designed system would lead to widespread theft and fraud," he said.

Juniper's research indicates that, to date, there is still a lack of commercial product development around CBDCs, with few well-defined platforms for central banks to take advantage of, a major limiting factor for today's market.

“While cross-border payments currently have high costs and slow transaction speeds, this area is not critical to CBDC development,” said Nick Maynard, Juniper's research manager. "Since the adoption of CBDCs will be very country-specific, it will be up to cross-border payment networks to link the systems together, allowing the broader payment industry to benefit from CBDCs."

To be successful, any CBDC platform would need a complete end-to-end financial network, including wholesale capabilities, a digital wallet, and merchant acceptance, Juniper said.

One of the challenges for central banks is figuring out how to enable a CBDC that adds value to existing payment systems, according to Gartner Research. The success of CBDCs also depends on the "programmability" enabled by smart contracts, Gartner argued in a January report.

“To further justify investments in CBDCs, developers are experimenting with injecting programmability into CBDC-enabled payment value chains,” Gartner said. "Therefore, bank CIOs need to prepare for this transformation."

As part of ongoing Digital Yuan, or e-CNY, pilot projects, for example, Bank of China Chengdu is using smart contracts to manage deposits for extracurricular school activities, such as museum trips. Using CBDC e-CNY reduces reliance on third parties to handle a refund if a class is canceled or a student is unable to attend, Gartner said.

Countries like Russia and China are seeing how payments that rely on US infrastructure and currency may be affected by sanctions and are working to develop alternatives, Steinberg said.

"The one to watch is China," Steinberg said, referring to the mBridge project. "Domestically, they need to prevent electronic payments from passing through to tech companies and certainly see the benefits of increased consumer surveillance. Internationally, they have piloted cross-border payments and settlements with bank plants in places Like Thailand and the United Arab Emirates, that's the current concern."

Copyright © 2023 IDG Communications, Inc.