Despite the US government moving cautiously to regulate and adopt cryptocurrencies, new surveys show that the use of traditional financial services, such as bank accounts and cash, is already on the decline, especially among young customers. .

A survey published last week by global payment platform provider Thunes shed light on the shopping, social networking and money management habits of so-called "Zoomers", the Genz generation born in the mid-to-late 1990s.

The survey of 16-24 year olds living in 13 developed and emerging countries found that Gen Z is embracing new kinds of money management tools and has relatively little enthusiasm for traditional options like bank accounts. (In fact, 62% of respondents said they don't have one.) Mobile wallet usage, on the other hand, is growing rapidly; in some markets, nearly half of Zoomers now have a mobile wallet.

The Thunes survey revealed that mobile wallets or virtual wallets are gaining ground: in five of the 13 countries surveyed, mobile wallets were the most popular means of payment. (Mobile wallets store information from a credit card, debit card, coupons, and loyalty cards on a mobile device; they are also an essential storage component of cryptocurrencies and stablecoins.)

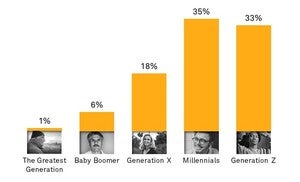

And in a separate 451 Research survey published on March 31, 20% of respondents said they had bought, exchanged, or received cryptocurrency. Adoption was strongest among Gen Z/Zoomers (33%) and Millennials (35%), finishing in the single digits for Baby Boomers and the Oldest Generation.

S&P 451 Global Market Intelligence Research

S&P 451 Global Market Intelligence Research

Have you ever bought, exchanged or received cryptocurrencies (eg Bitcoin, Dogecoin)?

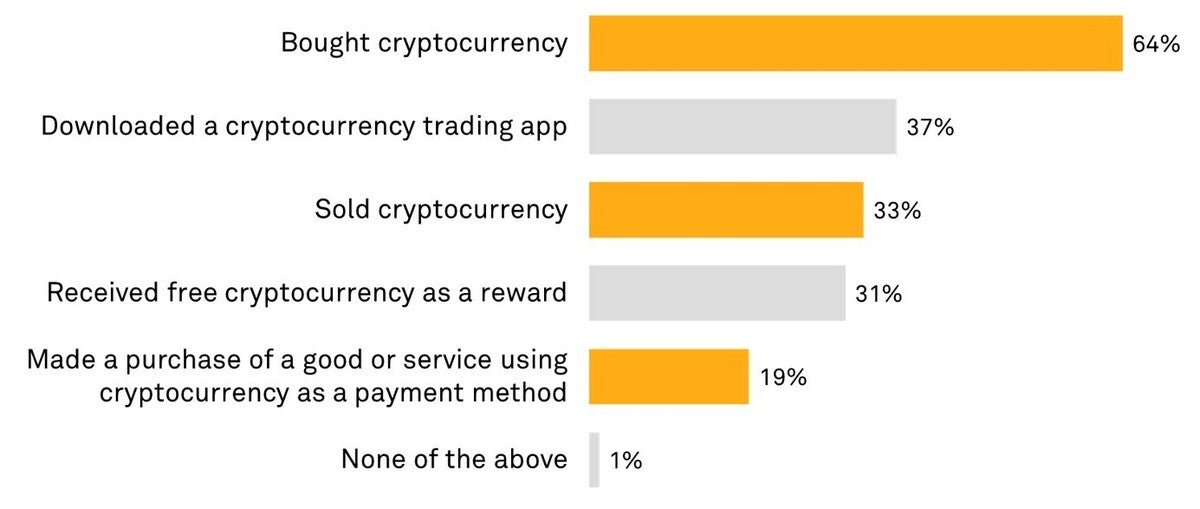

The 451 Research report indicates that more users bought cryptocurrencies as an investment tool than as a payment method.

“By exploring the specific activities that cryptocurrency participants have engaged in, the message is clear: while the majority have bought cryptocurrency (64%), a much smaller percentage sell it (33%) and an even smaller percentage use it. cryptocurrency as a form of payment (19%)," the report states. "Essentially, most consumers who interact with cryptocurrency treat it as an asset, just as they would a security (for example, stocks)."

On Friday, US Treasury Secretary Janet Yellen weighed in on the idea of a digital dollar, saying it "could become a form of fiat currency comparable to physical cash, but could offer some of the anticipated benefits." of digital assets.

“Digital assets may be relatively new, but they are part of a larger trend, the digitization of finance, that has been in the works for decades,” Yellen said at an event at American University. “In 1990, there were less than three million Internet users. Today there are about 4.500 billion, and we take it for granted that many aspects of our financial lives can be managed from small Internet-connected devices that fit in the palm of our hand.

Yellen also warned that the rise of stablecoins, a form of government-backed liquidity-linked electronic money, raises political concerns, including those related to illicit financing, user protection and systemic risk.

"And they are currently subject to inconsistent and fragmented oversight," Yellen said, adding that Treasury has worked with the President's Financial Markets Task Force, the Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of Currency (OCC). to study stablecoins.

S&P 451 Global Market Intelligence Research

S&P 451 Global Market Intelligence Research

Regarding cryptocurrencies, which of the following actions have you taken?

To peg their dollar stablecoin, most issuers back their coins with safe and liquid traditional assets, Yellen noted. In this way, when a user wants to exchange stablecoins for a dollar, the company has the money to make the change.

“But, for the moment, no one can guarantee that this will happen. In times of stress, this uncertainty could lead to a run,” he said. "It's not hypothetical."

Yellen was referring to a June 2021 run on Iron Finance's Titan token, the value of which fell from €65 to €30 in two hours. Iron Finance later said the run was due to some large holders selling their shares, causing others to panic.

Earlier this month, US President Joe Biden issued an executive order calling for more research into the development of a national digital currency through the Federal Reserve Bank, or "The Federal Reserve." . Lawmakers then followed up with their own bill, asking the Treasury to create an electronic dollar, a virtual representation of a US dollar.

The Thunes survey found that one of the most important factors for Zoomers when it comes to purchases and payment methods is brand trust; was cited as the top factor in choosing a primary payment method in seven of the 13 countries surveyed, including Western and emerging markets.

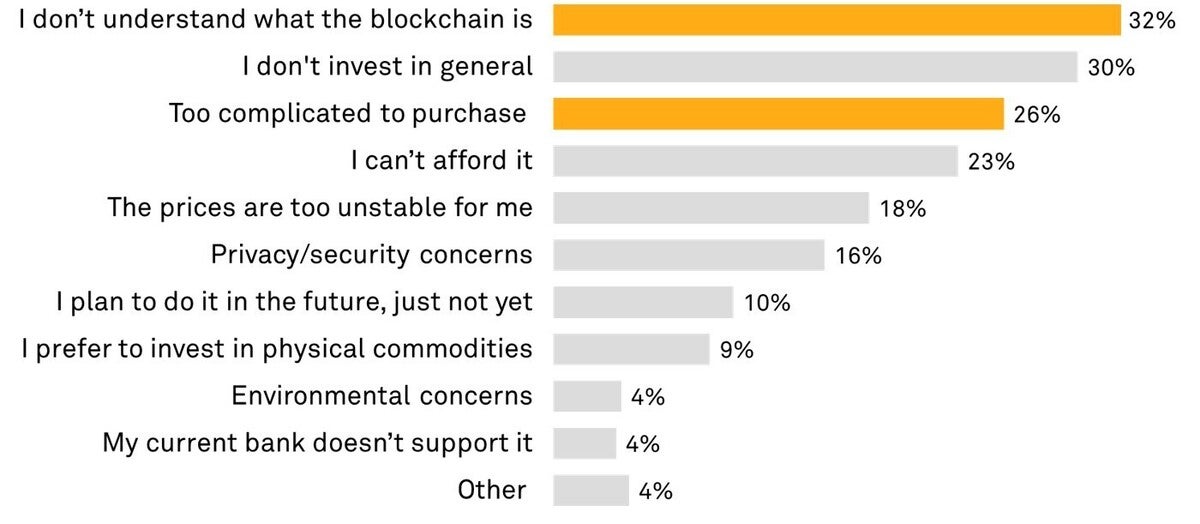

S&P 451 Global Market Intelligence Research

S&P 451 Global Market Intelligence Research

Why didn't you participate in cryptocurrency trading?

User experience was identified as the second most popular factor, which in an online world also affects loyalty.

“For many, Generation Z is a misunderstood and overlooked generation,” Thunes CEO Peter De Caluwe said in a statement. "This is a generation for whom 'dial-up' and 'desktop' are meaningless words and who don't just think 'mobile first' but live and breathe apps, social media, digital platforms and soon, the metaverse. We should start taking this generation seriously because the revenues and strategic plans of many companies, especially those that depend on rapid growth, depend on it.

The 451 Research report says that while financial institutions have largely avoided direct involvement in cryptocurrencies thus far, their survey indicated several potentially lower risk entry points, including:

- Rewards Redemption and loyalty points for cryptocurrencies. This could help issuers increase their appeal to millennials, more than half of whom (52%) have expressed interest in this usage. Startups like Bakkt are already moving in this direction.

- Receive crypto instead of credit or debit card reward points. Square, through its Cash Card, is an example of an issuer that already allows cardholders to earn cryptocurrency for certain purchases (for example, receiving 5% cash back in Bitcoin for a restaurant transaction). . Interest in this option was clear among high-income cardholders: 45% of respondents with an annual household income of more than €125,000 liked the idea.

- Link debit cards to cryptocurrency balances. Most cryptocurrency exchanges issue cards that consumers can implement to withdraw their crypto balances for in-store and online purchases, just as they would a debit card linked to their checking account. . Card issuers could partner with exchanges to link cardholders' crypto balances to their existing debit cards, with 42% of Gen Z and 47% of Millennials expressing interest in the idea.

Gen. Z/Zoomers group has nearly 2500 billion people worldwide; surpassed millennials in terms of population in 2019.

Mobile wallets are gaining traction in emerging markets where bank accounts have historically been difficult to access and financial exclusion is widespread. Mobile phone providers have led a digital payment revolution in Asia, while in Africa, major telecom providers have offered similar digital payment solutions, the Thunes report notes.

Social networks are part of the day to day life of Generation Z and are increasingly driving their economic activity. More than nine in 10 Gen Zers say they now use social media throughout the day, and the number of platforms they connect to continues to grow. Seven in 10 in the survey said they bought products discovered on social networks, such as Facebook and Tik Tok. TikTok is quickly catching up with YouTube, Facebook, and Instagram in popularity.

Surveys from Thunes and 451 Research shed light on how the world's youngest and most digitally savvy consumers are forcing changes to decades-old business practices.

"Failing to recognize the impending influence of digital native Zoomer could lead to declining sales of a once perfectly affordable brand," Caluwe said.

Copyright © 2022 IDG Communications, Inc.