WhatsApp Pay, the digital payment solution that integrates payments into the messaging app and allows users to send and receive money, could finally start in India if things go according to plan. entity owned by Facebook. The Reserve Bank of India (RBI) has reportedly told the Supreme Court of India that the National Payments Corporation of India (NPCI) has confirmed that WhatsApp is now fully compliant with data location standards. , the point at which service deployment was maintained. The Economic Times reports that in a letter dated June 5, NPCI, which operates the Unified Payment Interface (UPI), told the RBI that WhatsApp has now complied with data localization standards for the payment service. “NPCI has reviewed the 'Post Change Review Report III' certified by the independent third party auditor CERT-In of WhatsApp - Deloitte. We hereby declare that we are comfortable with the reports submitted by Deloitte regarding WhatsApp's full compliance with the remaining three points of the data storage guidelines issued by our office and are therefore in compliance with all five points of accordance with requirements set out in its (RBI) letter dated November 1, 2019," the Economic Times report quoted the letter to the RBI as saying. Deloitte was chosen to verify its compliance after being asked by NPCI to make certain changes regarding the location of the data.RBI's response is part of the proceedings in a public interest dispute (PIL) brought against WhatsApp Pay by the think tank for the Center for Accountability and Systemic Change (CASC). The CASC wanted the Supreme Court to stop the trial of WhatsApp with 1 million users and order the Reserve Bank of India (RBI) to record the authorization granted for the trial and to disclose all communications between WhatsApp, National Payments Corporation of India (NPCI)) and himself. WhatsApp Pay has been running a pilot project with 1 million users for almost two years. It has yet to receive authorization for full rollout with all of its 400 million Indian users, as it has not yet completed storing all data within the country's borders.

There are still some obstacles to overcome

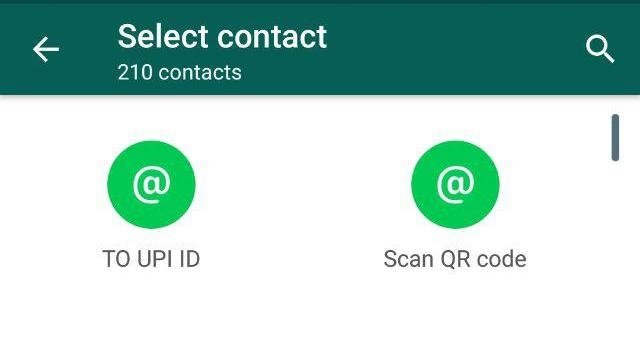

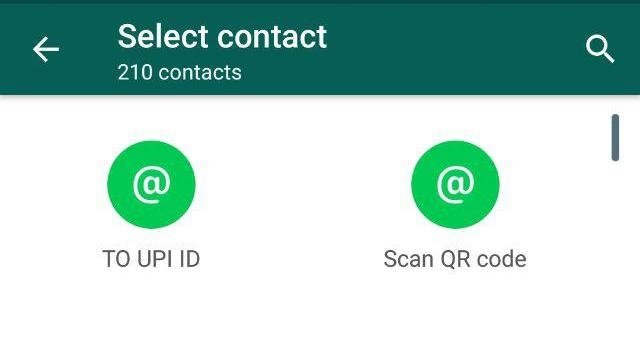

But RBI's latest disclosure to the Supreme Court does not naturally confirm that WhatsApp Pay has been given the green light. But it certainly marks an important step toward resolving the conflict that has held back the long-awaited service. WhatsApp Pay was beta tested in India in 2018 and has gathered 1 million users. The beta version launched in February 2018 and offered P2P functionality when users linked their accounts to a bank account. And it continued to comply with RBI data location regulations before the October 15, 2018 deadline by providing nationwide data storage. There is still a conflict between the government and WhatsApp. The messaging platform is not ready to honor requests to disclose the source of messages. WhatsApp stands by its position that it is not ready to break the sanctity of the end-to-end encryption it offers its users. A WhatsApp spokesperson had previously said that they are constantly working with the government to provide access to the payment feature to all of their users. Payments on WhatsApp is expected to drastically speed up digital transactions in India, especially in the current Covid-19 crisis. The social messaging app has over 400 million users in India and over 2 billion users worldwide. With these many app subscribers, India is currently the largest market for the app.

Jio looks intently

The WhatsApp Pay service, if and when it is offered in India, is expected to create a huge explosion in terms of digital transactions. WhastApp Pay aims to support already established digital payment gateways in the country, mainly Google Pay, PhonePe and Paytm. It seems that WhatsApp is well prepared for this contest. Its parent company Facebook bought a 9,9% stake in Reliance Jio for Rs 43.574 crore. The partnership between Facebook and Jio is unprecedented in many ways. Jio Platforms has an estimated user base of over 380 million across the country. Jio is betting big on WhatsApp Pay to continue its ambitious forays into commerce. WhatsApp Pay is expected to follow in the footsteps of WeChat Pay in China, which is building on the popularity of its parent platform. WeChat Pay is a leading player in the Chinese mobile payment market, with 800 million monthly active users (MAUs), and its success is due in large part to being part of the WeChat ecosystem, which has over 200 billion MAUs. Last week, WhatsApp India director Abhijit Bose said it could bring at least 18 million of its users to UPI, which is seeing steady growth in digital payments amid the pandemic. WhatsApp also plans to launch several pilot projects in areas such as digital loans, microinsurance and micropensions in XNUMX months. Brazil is another place where WhatsApp Pay was launched earlier this year. In this case, it was immediately discontinued to "preserve the competitive environment" just a week after its release. Source: Economic Times.