It's official: Netflix is back. Well, more or less, anyway.

To say that the biggest streamer in the world has had a rough 12 months is an understatement. With the war in Ukraine, the cost-of-living crisis hitting businesses and consumers hard, and Netflix's crackdown on account-swapping taking hold among its subscriber base, things have not been rosy for the company. transmission throughout 2022.

Netflix, sin embargo, parece haber dado finallymente la vuelta. In its Q2022 2,42 report (opens in a new tab), Netflix revealed that it added 2,6 million new subscribers to its global fan base – a year-over-year increase of just XNUMX%. , clear. Pero, dado that Netflix lost more than a million fanatics between the first and the second quarter of this year, sus últimas ganancias no deben ser despreciadas.

Recent streamer originals have played a big part in that growth. Stranger Thing season 4 has been a major factor in subscriber growth, with the latest episode of the hit Netflix show racking up an unprecedented 1350 billion hours of viewing since the release of Part 4 season 1 in late May. . Other blockbuster TV series that contributed to Netflix's subscriber growth include Monster: The Jeffrey Dahmer Story (824,15 million hours watched), The Sandman (351 million hours watched), Extraordinary Attorney Woo (402 million hours watched), broadcast) and Cobra Kai season 5 (270 million hours watched). million hours viewed).

On the Netflix movie side, The Gray Man (270 million hours streamed), Purple Hearts (229 million hours watched), and The Sea Beast (156 million cumulative hours) also helped Netflix in times of need. . In short, Netflix's Q2022 XNUMX slate effectively saved the streaming service from a winter of discontent.

With its original programming and movie listings for the past three months, Netflix has also gotten a welcome boost over its competitors. The streaming platform accounts for 7,6% of the total time US viewers spend in front of television, an audience share 1,4 times that of its closest rival on Disney Plus. Meanwhile, Prime Video lags even further behind, with Netflix's audience share 2,6 times that of the Amazon streamer. And that's despite the huge success The Rings of Power, the big-budget, fantasy Prime Video series, has had on Amazon's streaming service.

Netflix also enjoyed a period of sustained growth in the UK compared to its rivals, with an 8,2% audience share propelling Prime Video (2,3x) and Disney Plus (2,7x) out of the water. . It goes without saying that Netflix has a lot to celebrate.

Yet for all its recent successes, Netflix still finds itself adrift in troubled waters.

Despite its seemingly unlimited cash reserves and position as the world's largest streamer, Netflix lags behind HBO Max in the platform's movie-sharing department.

According to leading industry analysts Parrot Analytics, HBO Max has an 18,7% share of movie audiences (at least in the US) for all movies available on all platforms. This includes original, licensed-exclusive, and non-licensed-exclusive broadcasts. Compare that to Netflix's 15,3%, and clearly the streamer's boast about the success of movies like The Gray Man (read our interview with directors The Russo Brothers about its development) seems a bit over the top.

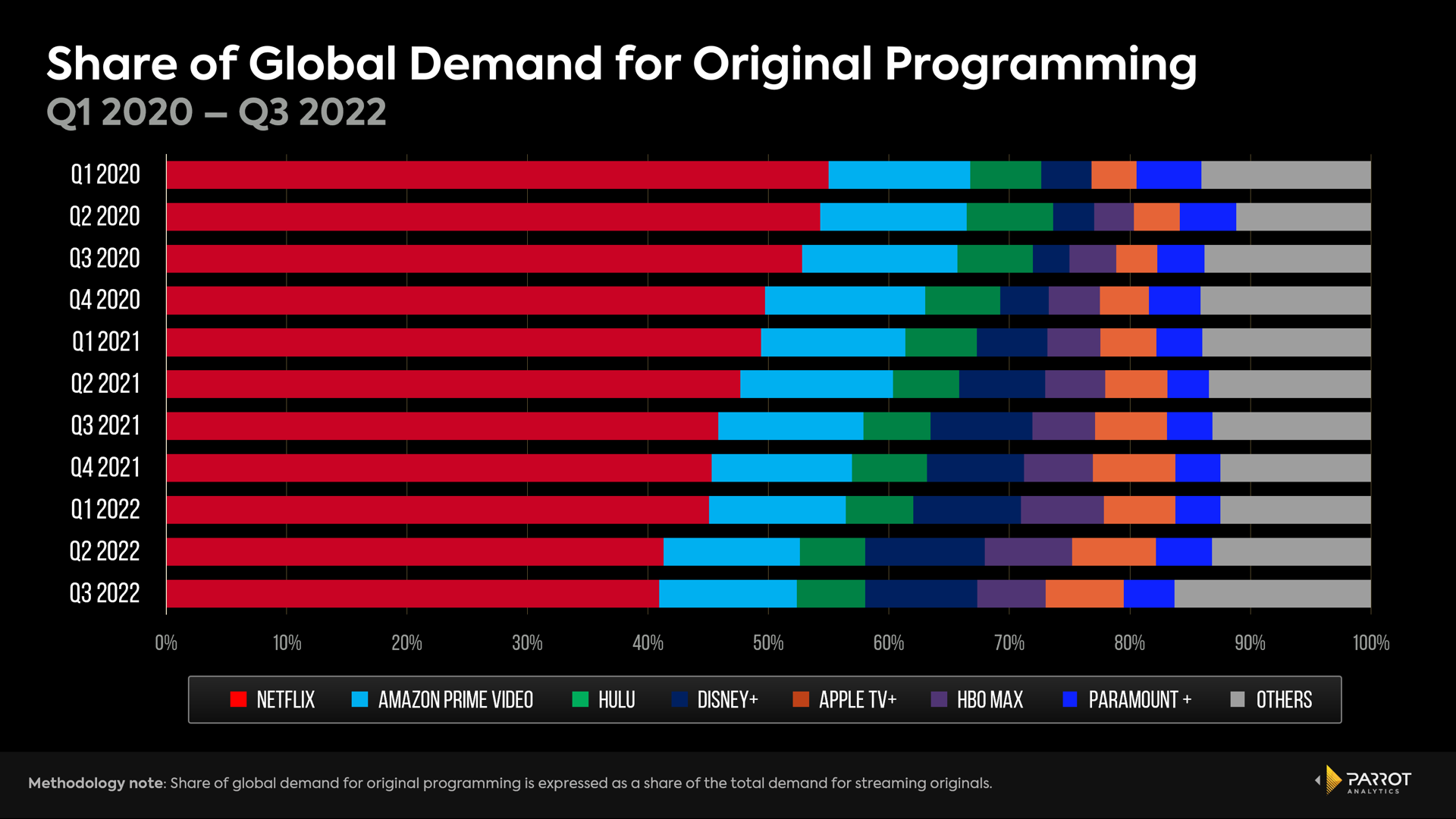

Netflix is also losing ground in the global demand race for original programming. According to Parrot Analytics, Netflix currently has 40,9% of the market, a figure that exceeds that of its competitors. However, Netflix's audience share was 45,8% in Q2021 5, meaning it lost almost 12% of its global audience demand in a 40,9-month period. Additionally, its 41,2% market share represents a slight decline from its 2022% share in QXNUMX XNUMX.

For all the good Stranger Things 4 and co. have done, Netflix isn't taking back control of its top six competitors. For the second consecutive quarter, this sextet -Prime Video, Disney Plus, HBO Max, Apple TV Plus, Paramount Plus and Hulu- shared a share of global demand (42,8%) higher than Netflix.

Clearly, the biggest TV shows on these six streamers slashed Netflix's market share again. HBO's House of the Dragon, Marvel and Disney Plus offerings of Star Wars, and Amazon's Lord of the Rings have taken substantial shares from Netflix. Again, things are not as good as Netflix might make them out to be.

And then there are Netflix's revenue streams. The streaming company may have increased its subscriber base, but financially it has yet to see a positive impact from a cash flow perspective. For the third quarter of 2022, Netflix saw its revenue fall to €7920 billion from €7970 billion in the second quarter of 2022, representing a 2,7% decline in year-over-year growth. Operating profit and net profit are also down slightly from the second quarter 2022 figures.

Given Netflix's downward trajectory from a monetary standpoint, it's no surprise that it's trying to turn around its financial fortunes. The streamer canceled a bunch of shows in development earlier this year, and while its attempts to crack down on password sharing may be less painful than initially anticipated, it's not gaining a following. Also, Netflix's introduction of an ad-based subscription tier may entice new users to sign up, but according to a TechRadar survey, its current fan base won't accept the option of paying less for their subscription if it means having to put up with it. ads every 15 minutes.

Speaking after the filing of Netflix's latest earnings report, Zuora CEO and founder Tien Tzuo said: "It's a new era of streaming competition and the race is on to create the right offering, for the right subscriber. "At the right time. Netflix's new tier announcement is a great start, but they still need to strive to be more agile and dynamic, with packaging and packaging, to continue to compete with Disney and HBO."

Yes, on the surface, Netflix is turning the tide. Their recent launch schedule has paid off and in the long run the streamer should see a stable ship from the subscriber's perspective.

Under the hood, though, things aren't as universally positive as Netflix makes them out to be. You should always be aware of the threat posed by your competitors, whose own slate of original programming continues to dent Netflix's dominance in the streaming landscape. As long as Netflix does its homework and doesn't get complacent, it should keep the crown it's held for so long. Don't, however, and subscribers could start going elsewhere to get their streaming fix permanently.

Today's best Netflix deals

(opens in a new tab) (opens in a new tab) (opens in a new tab)